Car Insurance In Rochester, NY

Coverage Tailored to Your Unique Needs in the Sunshine State

Car insurance in Rochester, NY has gotten more expensive in the past several years

Although it’s cheaper than in other cities in the state. With its snowy winters and busy city streets, having the right auto insurance policy is essential for Rochester drivers. In this comprehensive guide, we’ll dive into car insurance details in Rochester, including average rates, coverage types, top insurers, and agencies in the area.

Average Car Insurance Rates in Rochester, NY

According to the latest data from the New York State Department of Financial Services, the average annual cost for full coverage car insurance in Rochester is $1,942. This rate is slightly higher than the statewide average of $1,889 per year. However, it’s important to note that individual rates can vary significantly based on factors such as driving history, age, vehicle make and model, and the specific coverage levels chosen.

For liability-only coverage, the average annual cost in Rochester is $1,078, which is lower than the statewide average of $1,192. Liability insurance is the minimum required coverage in New York, but it only covers damages and injuries to others in an accident, not your own vehicle or medical expenses.

Types of Car Insurance Coverage

When it comes to car insurance, there are several different coverage types to consider. Understanding the various options can help you choose the right policy for your needs and budget.

- Liability Coverage

Liability coverage is the minimum required by law in New York State. It consists of two parts:

- Bodily Injury Liability: This coverage pays for medical expenses and damages if you cause injury to others in an accident.

- Property Damage Liability: This coverage pays for damages to another person’s property, such as their vehicle or other belongings, if you cause an accident.

- Collision Coverage

Collision coverage pays for repairs to your own vehicle if it’s damaged in an accident, regardless of who was at fault. This coverage is typically required if you have a car loan or lease. - Comprehensive Coverage

Comprehensive coverage protects your vehicle against non-collision damages, such as theft, vandalism, weather-related incidents (like hail or falling tree branches), and collisions with animals. - Uninsured/Underinsured Motorist Coverage

This coverage provides protection if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage to pay for your damages and injuries. - Personal Injury Protection (PIP)

PIP, also known as “no-fault” coverage, pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of who caused the accident. - Rental Car Coverage

If your vehicle is in the shop for repairs after an accident, rental car coverage helps cover the cost of a rental vehicle while your car is being fixed.

Top 10 Car Insurance Companies in Rochester, NY

When shopping for car insurance in Rochester, you’ll have numerous options to choose from. Here are the top 10 car insurance companies in the area, based on market share:

1. Geico

2. State Farm

3. Allstate

4. Progressive

5. Nationwide

6. Travelers

7. Farmers

8. Liberty Mutual

9. USAA

10. Erie Insurance

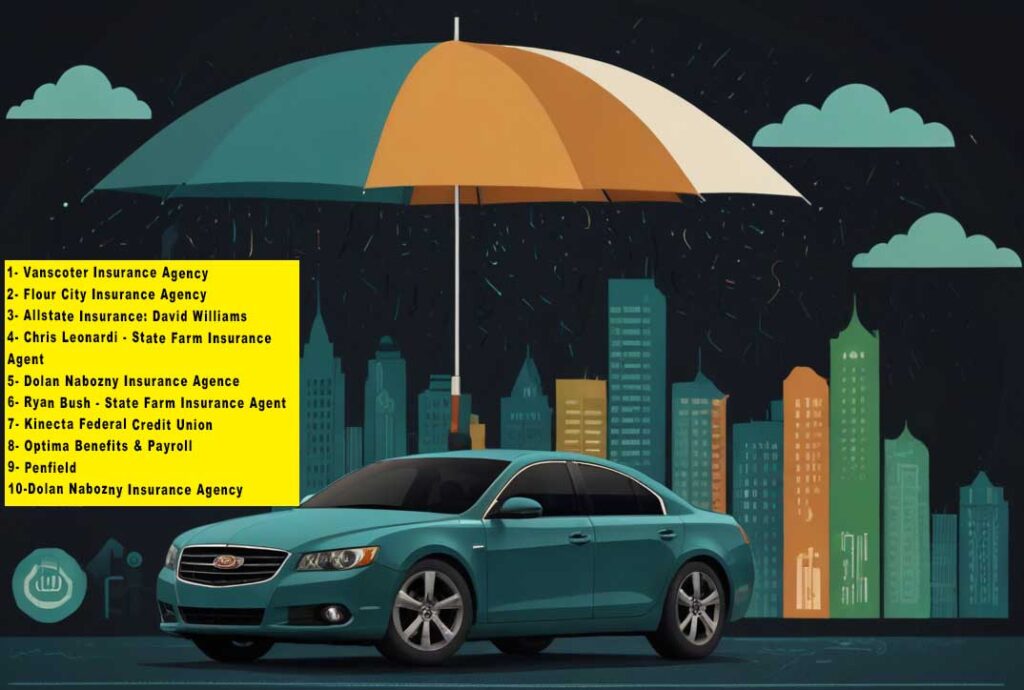

Top 10 Car Insurance Agencies in Rochester, NY

Here are the top 10 car insurance agencies in Rochester, NY.

- Lawley Insurance

1835 East Ridge Rd, Rochester, NY 14622

(585) 342-1323 - Keefe Insurance Agency

5785 W Henrietta Rd, West Henrietta, NY 14586

(585) 334-8180 - Fallon Insurance Agency

2745 Ridgeway Ave, Rochester, NY 14626

(585) 225-2000 - Salvatore Insurance Agency

700 Calkins Rd, Rochester, NY 14623

(585) 292-9100 - Fenton Associates

251 Sanford St, Rochester, NY 14620

(585) 232-7760 - The Keane Insurance Agency

2305 Buffalo Rd, Rochester, NY 14624

(585) 328-0100 - Bove Insurance Agency

1685 Mt Read Blvd, Rochester, NY 14606

(585) 865-5700 - Morgan Tine Insurance Agency

2350 E Ridge Rd, Rochester, NY 14622

(585) 467-4110 - Gerry F. McNicholas Insurance Agency

2586 Ridgeway Ave, Rochester, NY 14626

(585) 225-9090 - Midvale Insurance Agency

1411 Fairport Rd, Fairport, NY 14450

(585) 388-8841

Choosing the Right Car Insurance Coverage

When selecting the best car insurance coverage in Rochester, it’s essential to consider your individual needs and budget. While liability insurance is the minimum requirement, it may not provide adequate protection in case of a serious accident. Here are some factors to consider when choosing your coverage levels:

- Deductibles

A higher deductible (the amount you pay out-of-pocket before your insurance kicks in) can lower your premiums, but it also means you’ll have to pay more upfront if you file a claim. - Vehicle Value

If you have an older vehicle with a low value, you may want to consider dropping collision and comprehensive coverage to save on premiums. - Driving History

A clean driving record can help you qualify for lower rates and discounts, while accidents or violations can increase your premiums. - Age and Marital Status

Younger drivers and single individuals typically pay higher rates than older, married drivers. - Bundling Policies

Many insurers offer discounts if you bundle your car insurance with other policies, such as home or renters insurance.

Tips for Saving on Car Insurance in Rochester, NY

While car insurance is a necessary expense, there are several ways to save money on your premiums in Rochester:

- Shop Around and Compare Rates

Don’t settle for the first quote you receive. Compare rates from multiple insurers to find the best deal. - Take Advantage of Discounts

Many insurers offer discounts for things like good driving records, taking defensive driving courses, being a student or military member, and bundling policies. - Raise Your Deductible

Increasing your deductible can significantly lower your premiums, but make sure you have enough savings to cover the higher out-of-pocket costs if you file a claim. - Consider Usage-Based Insurance

Some insurers offer usage-based insurance, where your rates are calculated based on your actual driving habits, as tracked by a device installed in your vehicle. - Maintain a Good Credit Score

In New York, insurers are allowed to consider your credit score when setting rates, so maintaining a good credit history can help you get lower premiums. - Review Your Coverage Annually

Your insurance needs may change over time, so it’s a good idea to review your coverage and make adjustments as needed to ensure you’re paying for only what you need.

The Final Word On Car Insurance In Rochester, NY

If you drive a vehicle in Rochester, New York, it must be insured, because it’s the law. Although rates have climbed in recent years you can still get a good deal if you shop around and take advantage of discounts like bundling.

By understanding the average rates, coverage types, top insurers, and agencies in the area, you can make a smart decision when selecting the right policy for your needs and budget. To get your custom online car insurance quote in Rochester, NY just enter your zip code and fill out an application in about five minutes. Get the best coverage today for less.